How Borrowing Agile Principles Can Transform Your Financial Life

If you’ve ever felt overwhelmed by the complexity of managing your money, you’re not alone. Most of us set ambitious financial goals—save for a house, pay off debt, invest for retirement—only to lose momentum as life gets busy and circumstances change. But what if there was a way to bring the flexibility and focus of modern software development into your personal finances? Enter the Agile Money Method, a dynamic approach inspired by the iterative, team-driven world of Agile development.

Why Agile? A New Lens for Money Management

Agile methodologies have revolutionized how tech teams work, enabling rapid adaptation and continuous improvement. The same principles—short sprints, regular reviews, and collaborative problem-solving—can help you break down big financial goals into manageable steps, adapt to surprises, and celebrate progress along the way[1].

Key Principles of Agile Finance

- Iterative Progress: Work in short “sprints” (1–4 weeks) to tackle specific financial goals.

- Flexibility: Adjust your strategy as circumstances and information change.

- Regular Review: Use “retrospectives” to reflect, learn, and improve.

- Collaboration: Involve partners or family in goal-setting and decision-making.

Setting Up Financial Sprints

Think of a sprint as a focused period where you work toward a clear, achievable objective. Instead of vague annual resolutions, you’ll set 2-week goals and track your progress.

How to Start:

- Choose Your Sprint Length: Two weeks is ideal for most people—long enough to see results, short enough to stay motivated.

- Set 1–3 Goals: Examples include tracking all expenses, opening a high-yield savings account, or increasing retirement contributions.

- Break Down Tasks: List the specific actions for each goal. For instance, “Track all expenses” might mean downloading a budgeting app and logging receipts daily.

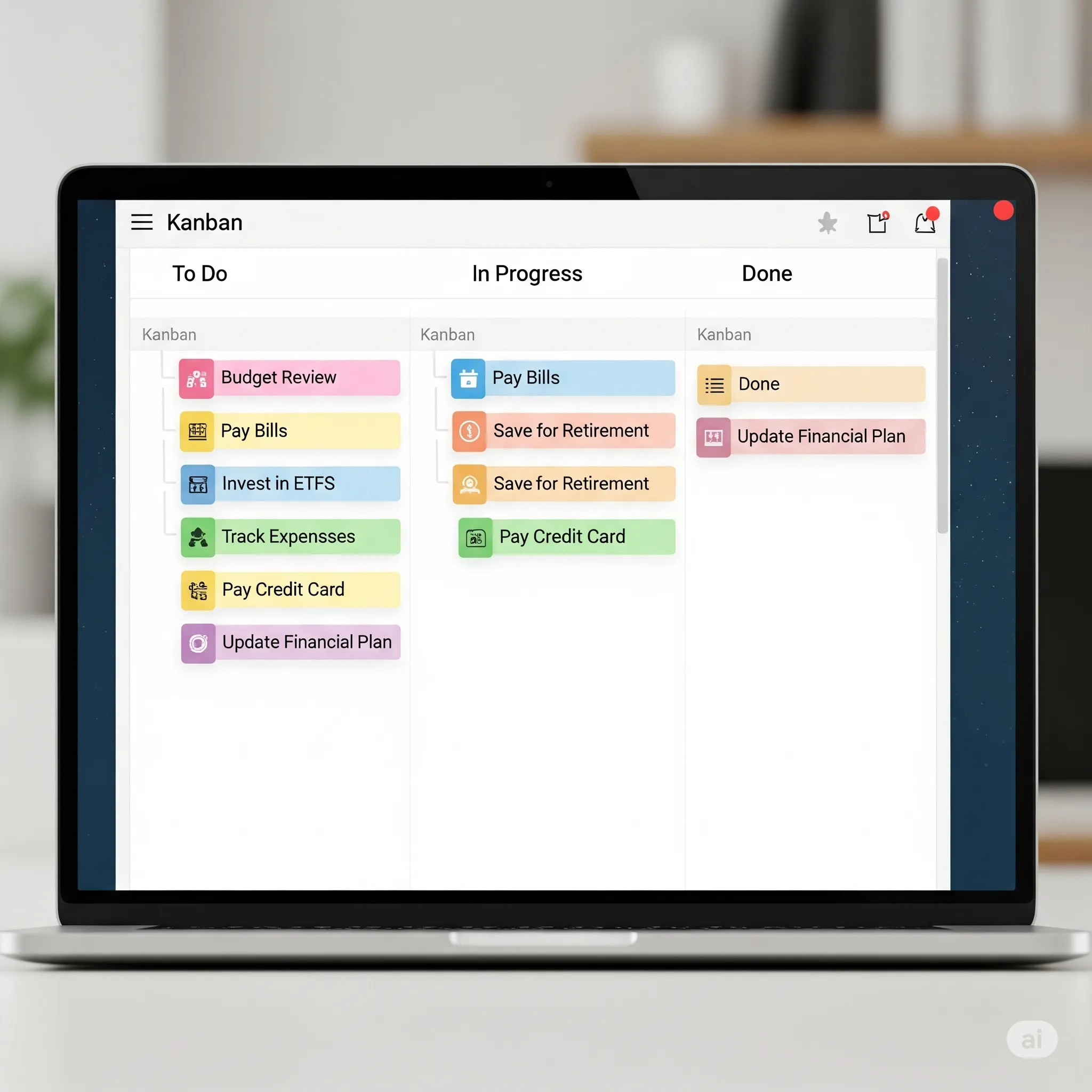

- Visualize Progress: Use a simple Kanban board (physical or digital) with “To Do,” “In Progress,” and “Done” columns.

- Daily Check-ins: Spend five minutes reviewing your goals and updating your board.

Real Example: During her first sprint, Linda tracked every expense and discovered she was spending twice as much on takeout as she thought. By breaking the goal into daily actions, she quickly identified areas to cut back[2].

Pro Tip: Try the free Time Money Code Financial Planner to set, track, and adjust your sprint goals.

Conducting Money Retrospectives

At the end of each sprint, schedule a 30–60 minute retrospective. This is your chance to reflect, learn, and plan the next steps.

Steps for a Successful Retrospective:

- Gather Data: Review your expense tracker, savings rate, and investment performance.

- Ask Key Questions:

- What went well?

- Where did you fall short?

- What unexpected challenges or opportunities arose?

- Identify Action Items: Choose 2–3 improvements for the next sprint.

- Document Insights: Keep a journal or spreadsheet to spot patterns over time.

Case Study: Alex and Sam, a couple saving for a house, realized during their retrospective that car repairs had derailed their savings plan. Instead of getting discouraged, they set a new action item: start an emergency fund for future surprises[3].

Actionable Tip: Explore the Time Money Code Portfolio Rebalancer to keep your investments aligned with your goals.

Agile Finance in Practice: Stories and Surprises

Let’s follow Alex and Sam through two sprints:

Sprint 1 (Weeks 1–2): - Track all expenses - Calculate savings rate - Research home prices

Retrospective 1: - Win: Tracked expenses successfully - Challenge: Overspending on dining out - Action: Set a dining out budget for next sprint

Sprint 2 (Weeks 3–4): - Implement dining out budget - Cancel unused subscriptions - Open a high-yield savings account

Retrospective 2: - Win: Cut dining expenses by 30% - Challenge: Car repair reduced savings - Action: Start emergency fund

By working in sprints and conducting regular retrospectives, Alex and Sam made steady progress, adapted to setbacks, and stayed motivated.

Staying Motivated and Avoiding Burnout

Short sprints and daily check-ins help maintain momentum. Celebrate small wins—like sticking to a budget for a week—to boost motivation. Research shows that frequent, achievable goals help rewire habits and make change stick[4].

Agile for Irregular Income: Freelancers and Gig Workers

Agile finance works for those with variable income, too. Instead of fixed goals, set percentage-based targets (e.g., save 10% of each payment) and use micro-retrospectives to adjust quickly. Peer accountability groups can help maintain discipline and share strategies.

Psychology of Agile Finance: Habits and Mindset

Reflection and iteration foster resilience. By reframing setbacks as learning opportunities, you build a growth mindset. Celebrating progress—even if imperfect—boosts confidence and reduces stress[5].

Conflict & Collaboration: Working Together

For couples and families, Agile finance encourages open communication. Use retrospectives to discuss what’s working and what’s not, and set shared goals. If disagreements arise, focus on facts and shared values, not blame.

Handling Setbacks: Learning from Missed Goals

Missed goals aren’t failures—they’re feedback. Document what happened, adjust your approach, and try again. Over time, you’ll spot patterns and build resilience.

Toolbox: Recommended Apps and Digital Tools

- Trello: Kanban boards for tracking sprints

- Habitica: Gamified habit tracking

- YNAB (You Need A Budget): Real-time budgeting

- Time Money Code: Financial planner and portfolio rebalancer

Comparisons: Agile Finance vs. Traditional Methods

Unlike static budgets, Agile finance adapts to change and focuses on progress, not perfection. It’s more flexible than zero-based budgeting and more actionable than the envelope system.

Measuring Success: Beyond the Numbers

Track habits, mindset shifts, and stress levels—not just dollars. Success is about building confidence and control, not just reaching a number.

Leveraging Technology for Agile Finance

Modern tools can automate and simplify your Agile Money journey:

- Financial Planner Apps: Set and track sprint goals, visualize progress, and adjust plans.

- Portfolio Rebalancer Tools: Review and rebalance investments during retrospectives.

- Automatic Transfers: “Pay yourself first” by automating savings and investments.

- Budgeting Apps: Real-time expense tracking provides valuable data for retrospectives.

Example: Linda set up automatic transfers to her savings account at the start of each sprint, ensuring consistent progress even when life got busy[6].

Conclusion: Embracing Financial Agility

The Agile Money Method isn’t just about managing money—it’s about optimizing your financial life for growth, resilience, and joy. By breaking big goals into sprints, reflecting regularly, and adapting to change, you’ll build habits that last and results that matter.

Start your first financial sprint today. Track your progress, reflect honestly, and celebrate every win—no matter how small. With the right mindset and tools, you can take control of your financial future, one iteration at a time.

References

- Beck, K. et al. (2001). Manifesto for Agile Software Development. [agilemanifesto.org]

- “How Budgeting Apps Help Track Spending.” Consumer Reports, 2024.

- “Emergency Funds: Why They Matter.” NerdWallet, 2025.

- Duhigg, C. (2012). The Power of Habit. Random House.

- Duckworth, A. (2016). Grit: The Power of Passion and Perseverance. Scribner.

- “Automating Savings: The Pay Yourself First Principle.” Investopedia, 2025.