Chapter 1: The Morning You Forgot to Pay Your Bills — and Why That’s a Good Thing

At 7:43 a.m. in Austin, Texas, Maya Chen cradled her cappuccino, scrolling through weekend brunch options. Unbeknownst to her, her bank account had already paid rent, rebalanced her investment portfolio, and diverted 5% of her latest freelance check to an emergency fund. No missed deadlines. No stress.

That’s not a fantasy. It’s the financial future already unfolding.

According to a 2024 Experian study, 67% of Gen Z and 62% of Millennials now use generative AI for managing finances—budgeting, investing, and boosting credit scores. Even more striking, 77% of those users engage weekly, signaling that automation isn’t just a trend. It’s a habit.¹

For Maya, automation means freedom. For the rest of us, it means a reckoning with how we think about money, discipline, and trust in machines.

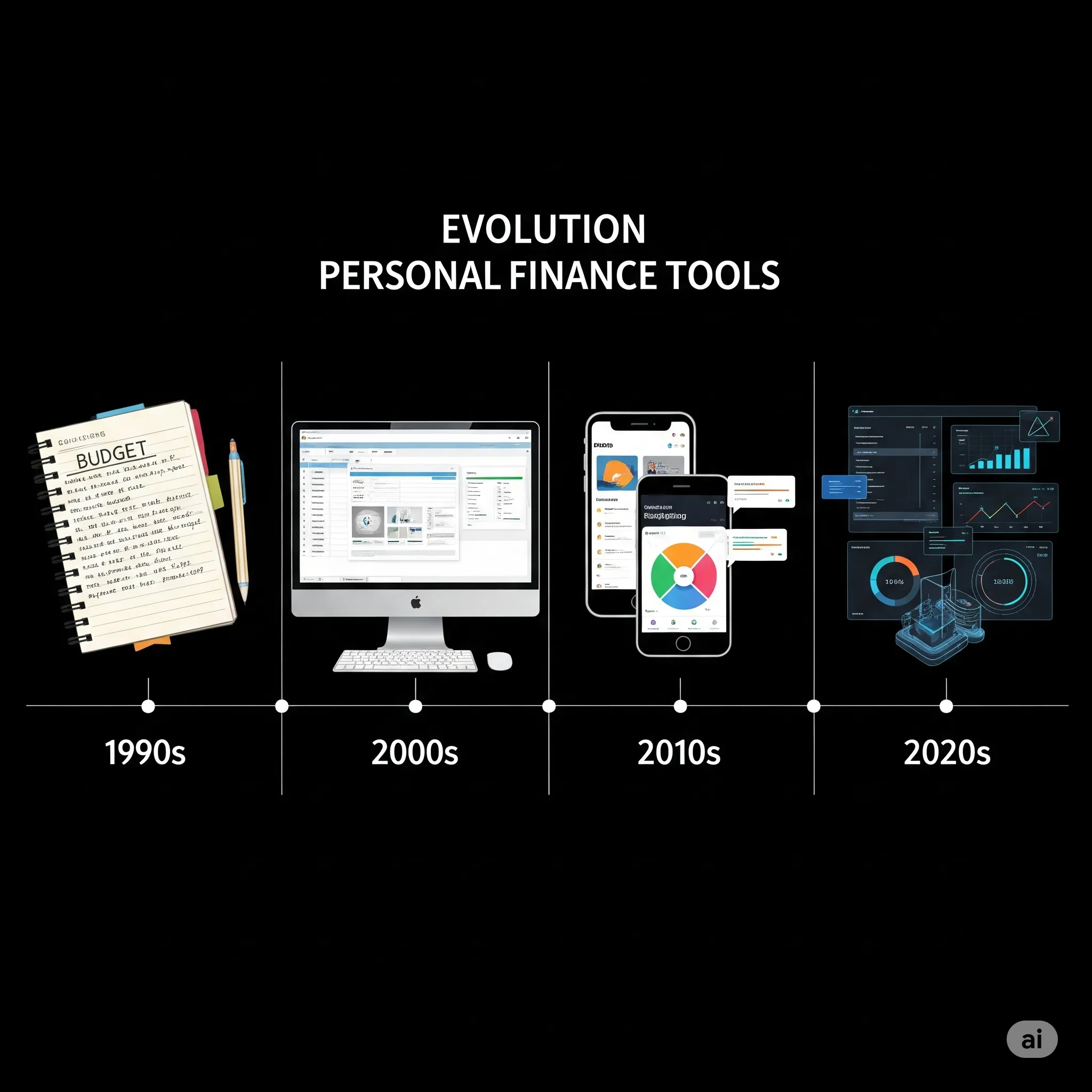

Chapter 2: From Envelopes to Algorithms — A Generational Leap

Our relationship with money used to be analog—budget envelopes, handwritten ledgers, and checkbooks. Then came spreadsheets, then apps, then AI. Now, many young adults skip budgeting entirely—instead, they configure it.

The World Economic Forum reports that 41% of Gen Z and Millennials in 13 countries are comfortable letting AI manage their investments. Among Boomers? Just 14%. The divide is not just about tech—it’s about trust.²

This generational shift reflects more than comfort with technology. It reflects a mindset: delegate the routine, so you can focus on the meaningful.

Take Chris, a 29-year-old software engineer in Seattle. Every paycheck triggers an automated cascade: 10% to a Roth IRA, 5% to crypto (with stop-loss settings), 20% to high-yield savings, and the rest to an expenses account—with auto-categorized spending alerts. "I don’t budget," he says. "I design systems."

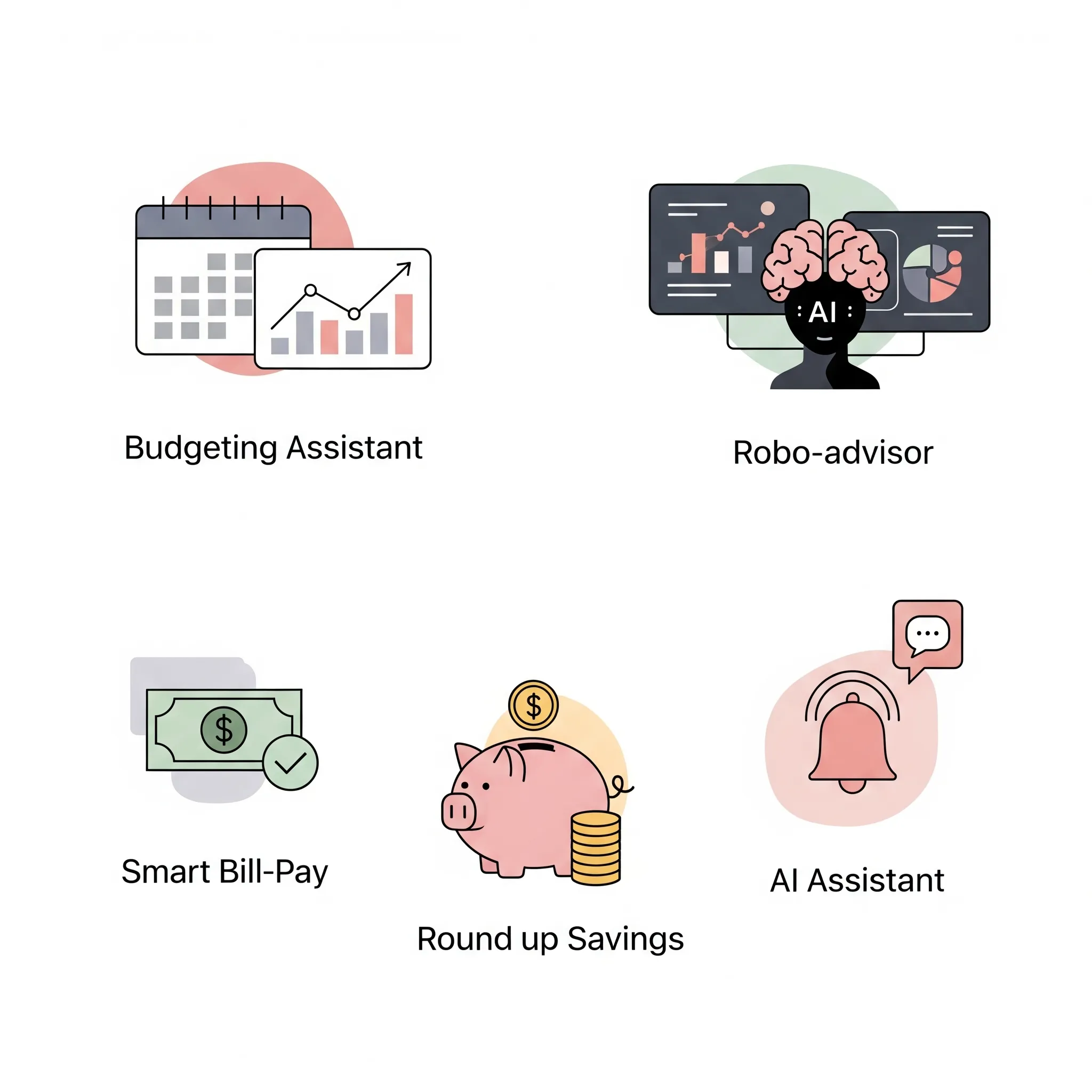

Chapter 3: What’s Actually Powering the Shift — Your 2025 Toolkit

Automation today is less about convenience and more about capability. Here’s what’s quietly running in the background of millions of accounts:

AI-Powered Budgeting Assistants

Tools like Copilot, Cleo, and YNAB use machine learning to detect patterns, forecast shortfalls, and nudge you when spending spikes. Experian confirms users check in at least weekly.¹

Autopilot Investing

Platforms like Betterment and Wealthfront use robo-advisors that rebalance your portfolio based on real-time market activity and your personal risk tolerance.³

Smart Bill-Pay Systems

Apps like Tally and Truebill prevent missed due dates, avoid late fees, and eliminate duplicate subscriptions—all without a calendar reminder.

Neobank + Fintech Integrations

Modern banks now offer "round-up" savings rules (e.g., round every $3.50 latte to $4, and stash the difference). Coupled with APIs from fintech startups, these rules multiply small behaviors into big savings.

Proactive AI Financial Agents

According to Deloitte, nearly 77% of Gen Z and Millennials believe AI will play a role in their daily work. That familiarity is bleeding into their financial lives, making tools like ChatGPT’s financial plug-ins and Google Bard’s budget projections feel intuitive.⁴

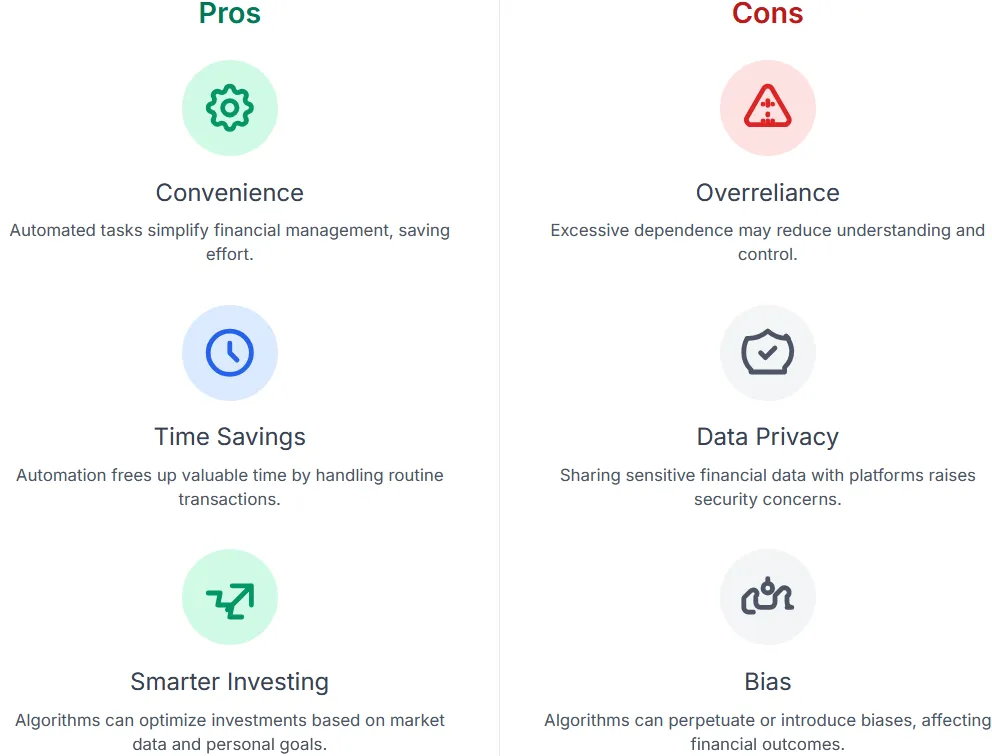

Chapter 4: The Double-Edged Algorithm — Benefits and Blind Spots

Financial automation offers real wins—but also real risks. As the systems get smarter, so must the humans using them.

The Rewards

-

High Satisfaction: 96% of users report a positive experience.¹

-

Trust in Machines: 38% of users trust AI as much—or more—than human advisors.¹

-

Increased Productivity: Users report automation helps them feel more "on top" of money, with 67% citing improved focus and peace of mind.⁵

The Risks

-

Overreliance: Algorithms can miss context—a rent increase, a bank error, or a fraud charge may go unnoticed until too late.

-

Algorithmic Bias: AI tools can replicate inequities if trained on biased historical data—denying credit or misjudging risk.

-

Data Privacy: Automated systems gather detailed personal info. Without strict data governance, leaks or misuse remain a threat.

As Christina Roman of Experian notes: "Generative AI can help consumers improve their financial literacy—but they must verify their findings."⁶

Chapter 5: Building Your Automated Wallet — A Responsible 2025 Playbook

Here’s how to automate without abdicating control:

-

Audit & Aggregate: Start by linking your accounts via a trusted aggregator (e.g., Plaid-backed apps). Get a dashboard view.

-

Automate Essentials: Schedule recurring payments for rent, loans, and utilities. Eliminate missed deadlines.

-

Smart Savings Rules: Use conditional triggers ("if checking > $1,200, move $100 to savings"). Treat rules like recipes.

-

Select a Robo-Advisor: Choose one with transparent fees and quarterly reviews—not just autopilot, but copilot.

-

Review Monthly: Automation isn’t abdication. Use monthly check-ins to adjust goals and detect outliers.

This model mirrors the hybrid AI-human approach praised by Oliver Wyman as the future of smart finance.³

Chapter 6: The Human in the Loop — What Experts Want You to Know

Christina Roman (Experian): “Generative AI can help create new opportunities for consumers looking to improve their financial literacy and overall financial health. But it’s not a silver bullet. Users must remain engaged.”

Natalya Guseva (World Economic Forum): “Younger generations are not just more likely to invest—they’re more likely to want tech-enabled guidance while doing so.”²

McKinsey Digital Report, 2025: "Super-agents—AI tools that assist decision-making, not just execute it—are essential to ensuring user empowerment rather than dependence."⁴

Epilogue: Letting Go — With Eyes Wide Open

Automation isn’t about losing control. It’s about reclaiming it.

It’s the ability to wake up and know your rent is paid, your investments are balanced, your savings are growing—and your mind is clear.

But peace of mind requires vigilance. The smartest systems still need smart oversight. Don’t check out—check in.

So, yes—let the machines move the money.

But let the meaning behind your money always remain human.

Citations:

-

Experian PLC, 2024. "Americans Are Embracing Gen AI to Make Smart Money Moves."

-

World Economic Forum, 2025. "Retail Investing Trends Among Young Investors."

-

Investopedia, 2025. "Millennials & Gen Z AI-Driven Investing Habits."

-

McKinsey Digital, 2025. "Superagency in the Workplace."

-

BusinessWire, 2024. "Survey: Gen Z and Millennials Use AI Regularly in Finance."

-

Experian News Blog, 2024. "Generative AI for Financial Success."

Have questions, feedback, or want to automate your wallet the right way? Start with a single rule—and watch what happens next.