Elite traders—those few who consistently outperform markets—are often viewed as lucky, gifted, or unusually bold. But the truth is less glamorous and more instructive: the best traders are relentless about their routines. Their edge comes not just from strategy, but from structure, reflection, and psychological self-regulation.

In this article, we’ll examine the daily habits, journaling techniques, and psychological practices of elite traders—and draw surprising parallels with athletes, chess grandmasters, and surgeons. This isn’t about mimicking rituals blindly. It’s about understanding how consistent behaviors sharpen performance under pressure.

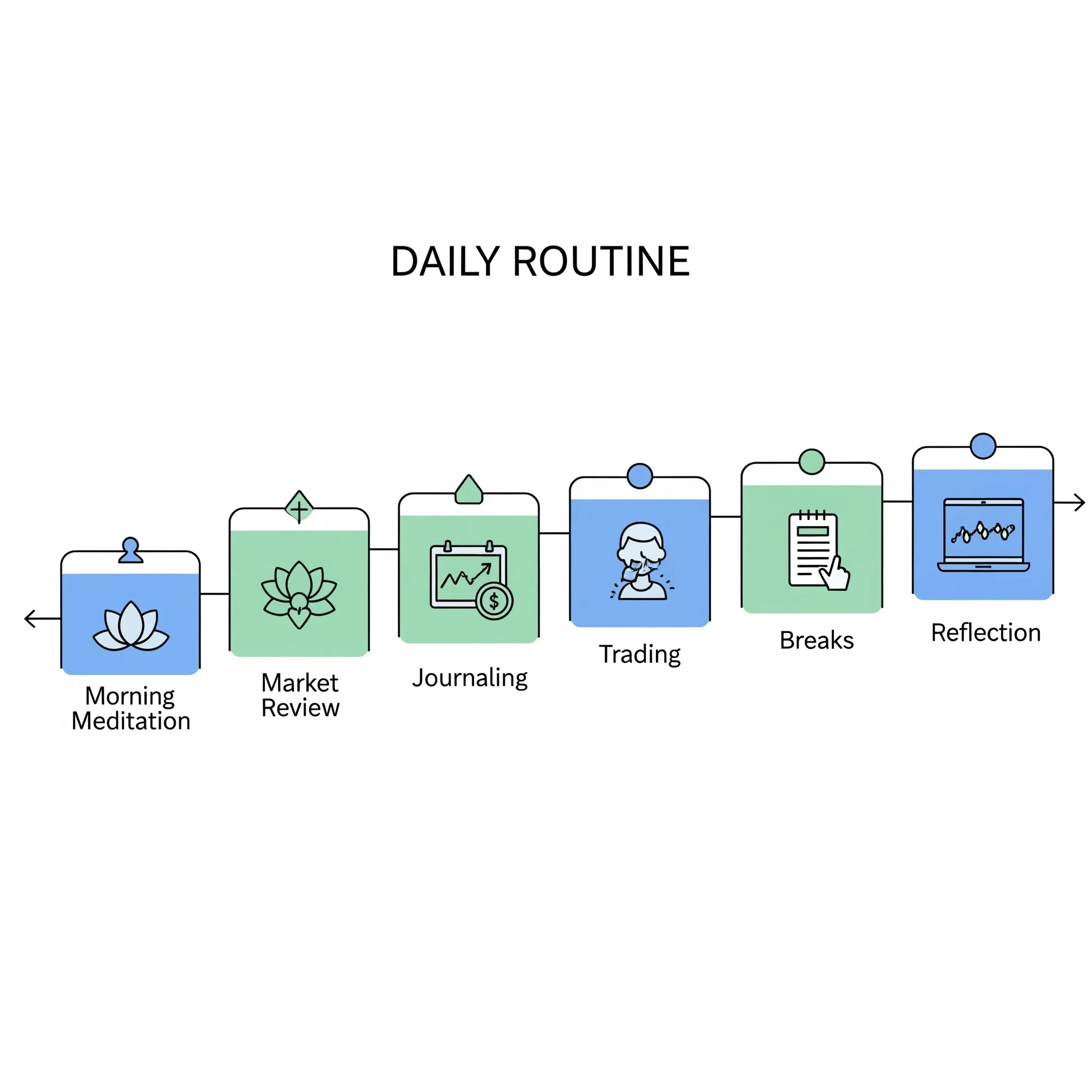

Routine as a Framework for Decision-Making

Top traders start their days deliberately. Many follow a morning routine that prioritizes clarity, energy, and emotional neutrality before they even look at a chart. A combination of meditation, physical movement, and journaling is common. These routines aren’t superstition—they're preparation for cognitive resilience [1].

For instance, Paul Tudor Jones reportedly uses breathing exercises before sessions to calm the nervous system [2], while others practice mindfulness to build emotional awareness before stepping into high-volatility environments [3].

A Day in the Life: What a Real Trading Routine Looks Like

While routines vary, here’s a composite example drawn from interviews and case studies of full-time professional traders:

-

5:30 AM – Wake, light mobility/stretch, 10 minutes of mindfulness meditation.

-

6:00 AM – Review overnight markets, prepare news dashboard, set alerts.

-

6:30 AM – Write a morning journal entry: emotional state, expectations, market context.

-

9:00 AM - 11:00 AM – Execute trades per plan. Speak thoughts aloud or record screen for review.

-

12:00 PM – Lunch break, no screens, short walk.

-

1:00 PM - 3:30 PM – Trade final sessions; take one "pause break" to check in on mood/energy.

-

4:00 PM – Post-trade review: log entries, write reflections, tag setups in journal.

-

5:00 PM – Close with a cognitive "cool-down": review key decisions, listen to calming music, disconnect.

This structure mirrors how elite athletes schedule training, execution, rest, and reflection—with intention and rhythm [4].

Inside the Journal: Templates and Prompts That Pros Use

Elite traders don’t just track numbers. They journal to uncover emotional patterns, biases, and behavioral triggers. A typical journal entry includes:

Quantitative Block:

-

Entry/Exit price

-

Setup/Strategy tag

-

Risk-reward ratio

-

Execution time

Qualitative Block:

-

What was my plan?

-

How did I feel entering the trade?

-

Did I follow my system? Why or why not?

-

What did I learn?

Bonus Prompt (weekly):

-

What emotion showed up most this week?

-

What non-market event influenced my trading?

Some traders even tag entries with emojis or energy levels to visualize psychological states over time. Others use tools like Notion or Obsidian to create searchable archives [5].

What Happens When the Routine Breaks?

Contrary to popular belief, elite traders aren’t immune to emotion—they’re simply better at recovering from setbacks. When things go wrong, they lean on fallback routines:

-

Write a non-market journal entry to regain perspective.

-

Go analog for a day—reading, walking, sketching—to reset mentally.

-

Speak with a coach, mentor, or trading partner to externalize emotions.

-

Revisit past successful trades and the mindset behind them to rebuild confidence.

This mirrors the “resilience loops” used by military personnel and trauma surgeons—structured decompression and reflection prevent spirals [6].

Unusual Tools and Techniques for Mental Control

Beyond the basics, some traders explore niche tools for gaining insight into their cognitive states:

-

Biofeedback apps (e.g., Inner Balance) to measure and manage heart rate variability.

-

Screen recording with voice commentary to review emotional tone.

-

Color-coded trading logs to detect pattern consistency and mental clarity.

-

Cognitive drills, such as executing simulated trades with random parameters to stay adaptive.

These practices reflect a growing awareness that trading is not just tactical—it’s deeply psychological.

Final Thoughts: Discipline Over Drama

What separates elite traders isn’t just strategy—it’s deliberate daily rituals that build mental durability. Their routines allow them to detach from outcomes, stay present in decisions, and remain curious under pressure. In the end, they’re not chasing perfection. They’re crafting systems that protect clarity.

Just like athletes stretch, rehearse, and reflect, traders prepare and process. Their rituals are not performance—they’re preparation for performance.

References:

-

Goleman, D. Emotional Intelligence, Bantam Books (1995).

-

Jack D. Schwager, Market Wizards, Wiley (1989).

-

Kabat-Zinn, J. Wherever You Go, There You Are, Hyperion (1994).

-

Ericsson, K. A., et al. The Role of Deliberate Practice in the Acquisition of Expert Performance, Psychological Review (1993).

-

TraderLion, “How Top Traders Journal Their Progress,” YouTube (2023).

-

Gawande, A. Better: A Surgeon's Notes on Performance, Picador (2007).