Backtesting is the quiet but indispensable work behind every trading strategy you’ve heard about. It is the process of replaying history, testing your ideas against past market data to see what might have worked and, just as importantly, what would not have. When I first started backtesting, I quickly realized it was as much a mental discipline as a technical one. There is a temptation to be seduced by smooth-looking equity curves or promising numbers, but beneath that surface lies a maze of pitfalls and biases.

This article shares my journey—from coding simple strategies in Pandas to exploring popular Python libraries, wrestling with common backtesting traps, and learning how experienced quants think about failure and discipline. If you are new or curious about algorithmic trading, I hope this reflection gives you both practical tools and a mindset to navigate the real world of backtesting.

Why Backtesting Matters and Why It Is Harder Than It Looks

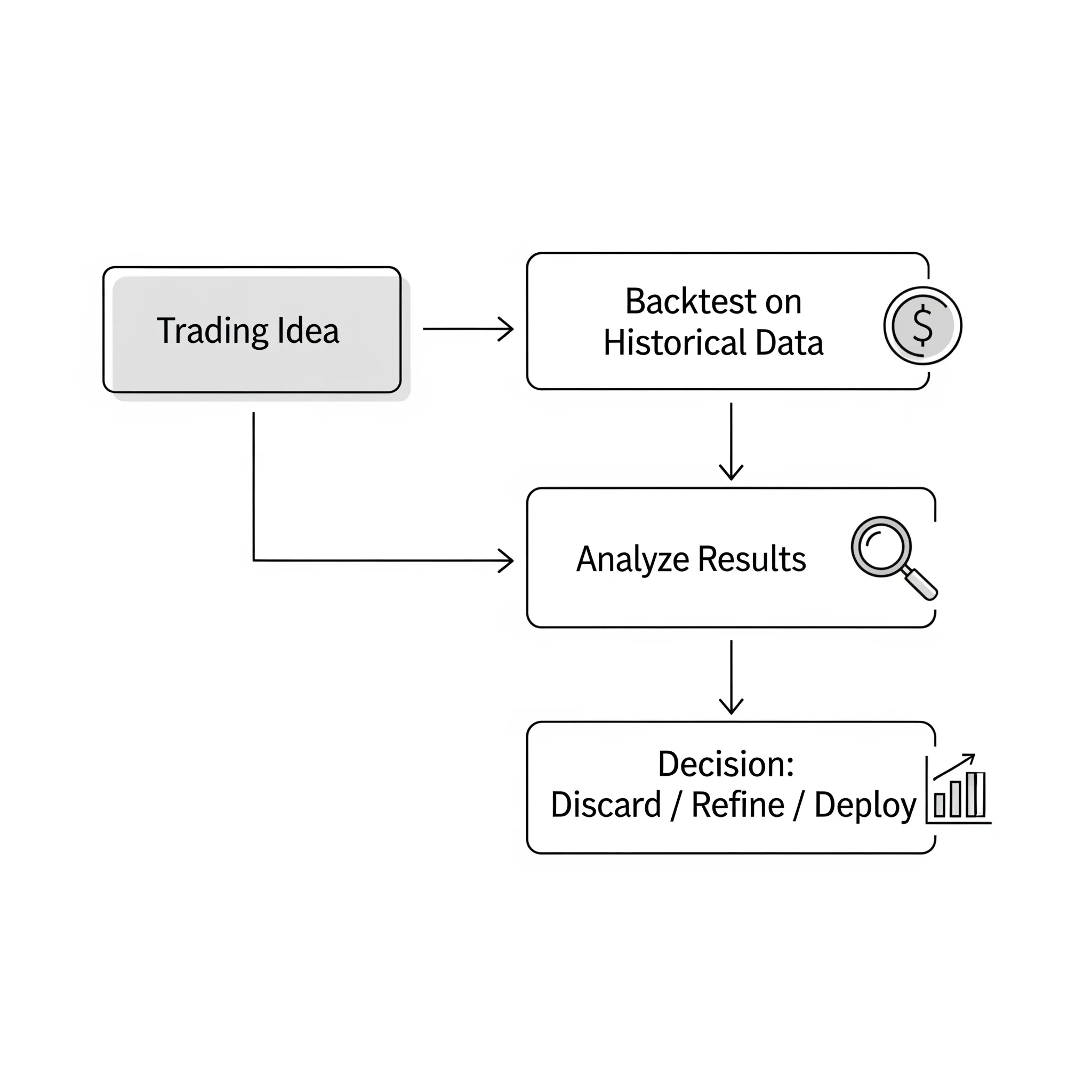

Backtesting’s goal is straightforward: test a trading idea on historical data to estimate potential performance without risking real money. However, trading is not just about numbers; it is about chaos and uncertainty. Markets change, rules evolve, and human behavior shifts.

I learned early on that backtests can fool you. Overfitting a strategy to past data often leads to dazzling backtests that fail miserably in live trading. Data issues such as survivorship bias—excluding stocks that disappeared—or look-ahead bias—peeking into the future—can inflate returns and lull you into false confidence.

Therefore, backtesting is not just programming. It is detective work: spotting hidden flaws, asking hard questions, and preparing to be wrong.

Starting Simple: Using Python and Pandas for Backtesting

My first backtests were written from scratch using Pandas. The beauty of Pandas is how quickly you can manipulate time series data and write simple logic like moving average crossovers. It gave me full control and a deep understanding.

Here is a small snippet showing a 20/50-day moving average crossover signal:

import pandas as pd

data['MA20'] = data['Close'].rolling(20).mean()

data['MA50'] = data['Close'].rolling(50).mean()

data['Signal'] = 0

data.loc[data['MA20'] > data['MA50'], 'Signal'] = 1

data.loc[data['MA20'] < data['MA50'], 'Signal'] = -1

Simple, flexible, and a great place to learn. However, Pandas alone cannot simulate order execution, slippage, commissions, or portfolio management realistically—features you will want for serious testing.

Exploring Popular Python Backtesting Libraries

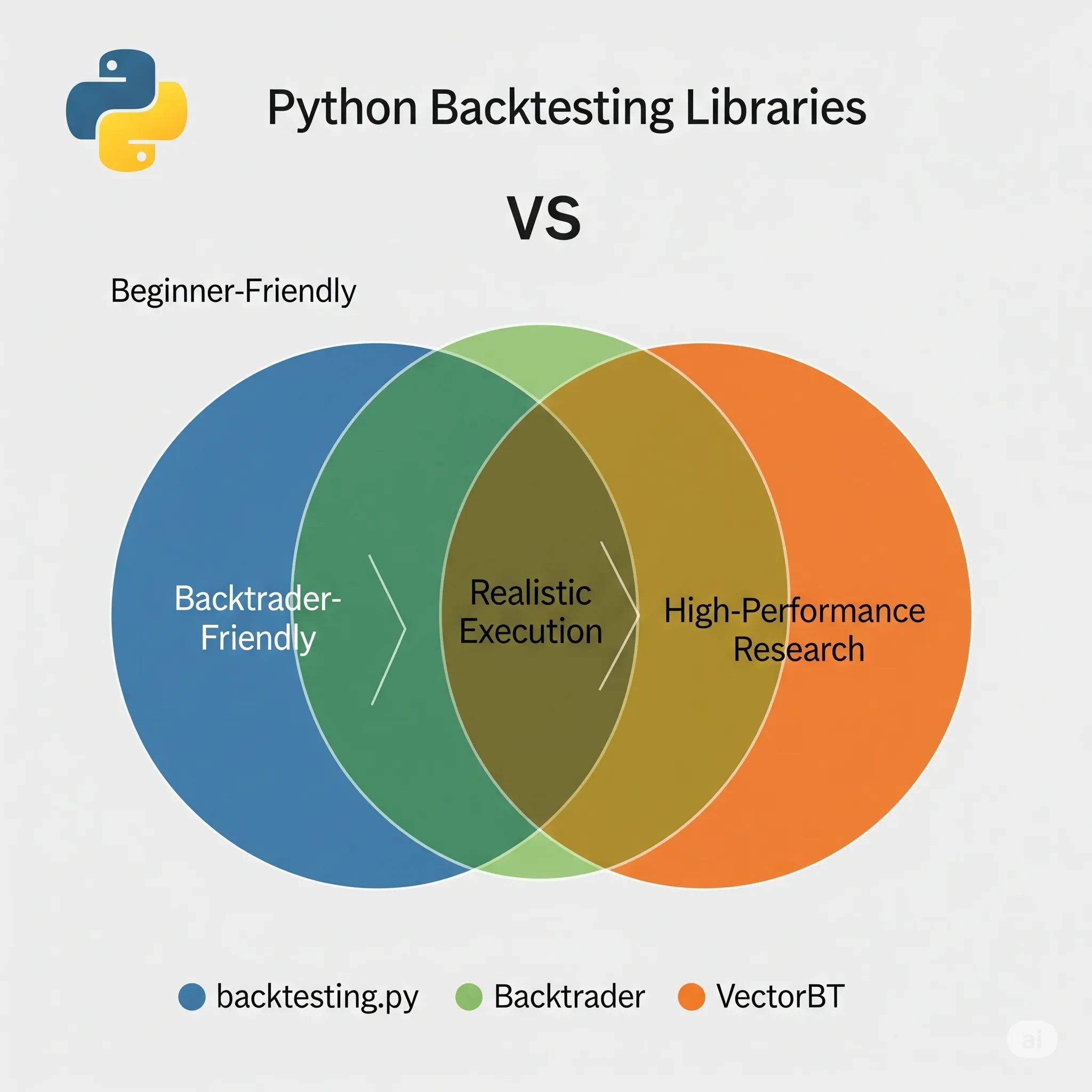

Python’s ecosystem offers a variety of tools that build on or complement Pandas. Each has its tradeoffs.

backtesting.py: Friendly and Fast for Beginners

Designed for quick prototyping with easy syntax, backtesting.py lets you write strategies concisely. Its simplicity is great for beginners exploring ideas. However, development has slowed, and it lacks some advanced features or live-trading support [1].

Key Features

-

Intuitive, clean API

-

Built-in plotting (interactive HTML or static)

-

Strategy definition through subclassing

Strategy -

Basic position management (

buy(),sell(),position) -

Supports commissions and slippage through parameters

-

Built-in performance metrics (Sharpe ratio, drawdown, CAGR, etc.)

-

Operates on per-bar logic through the

next()method

Limitations

-

No live-trading integration

-

Not designed for multi-asset or multi-timeframe strategies

-

Less efficient on large datasets

-

Limited customization for execution mechanics

-

Fewer advanced broker models and order types compared to competitors

Best Use Cases

-

Beginners learning backtesting fundamentals

-

Simple, single-asset strategies

-

Educational purposes

-

Rapid prototyping of basic ideas

Example Code

from backtesting import Backtest, Strategy

from backtesting.lib import crossover

import yfinance as yf

import pandas as pd

# Download data

data = yf.download('AAPL', start='2018-01-01', end='2024-01-01')

# Define strategy

class SmaCross(Strategy):

def init(self):

self.ma20 = self.data.Close.rolling(20).mean()

self.ma50 = self.data.Close.rolling(50).mean()

def next(self):

if crossover(self.ma20, self.ma50):

self.buy()

elif crossover(self.ma50, self.ma20):

self.sell()

# Run backtest

bt = Backtest(data, SmaCross, cash=10_000, commission=.002)

stats = bt.run()

bt.plot()

print(stats)

Backtrader: The Workhorse with Deep Features

Backtrader supports detailed event-driven simulations, broker integration, and live paper trading. It models commissions, slippage, and complex order types. Although updates have slowed, it remains a community favorite for growing traders wanting more realism [2].

Key Features

-

Event-driven architecture simulating brokers, orders, slippage, etc.

-

Supports multiple assets and multiple timeframes

-

Handles corporate actions like splits and dividends

-

Wide range of order types: stop, limit, bracket, OCO

-

Integration possibilities for paper/live-trading (IBKR, Oanda, via extensions)

-

Supports custom and pre-built indicators

-

Models cash, margin, slippage, commissions realistically

Visualization

- Built-in Matplotlib plots for trades, indicators, and portfolio values

Limitations

-

Verbose code relative to vectorized libraries

-

Steeper learning curve due to its architecture

-

Documentation is fragmented; community forums often necessary

-

Project development has slowed since 2020

Best Use Cases

-

Realistic modeling of order behavior and brokerage constraints

-

Multi-asset, multi-timeframe strategies

-

Transitioning strategies to live-trading scenarios

-

Research requiring detailed execution simulations

Code Example

import backtrader as bt

import yfinance as yf

import pandas as pd

# Download data

data = yf.download('AAPL', start='2018-01-01', end='2024-01-01')

# Convert for Backtrader

datafeed = bt.feeds.PandasData(dataname=data)

# Define strategy

class SmaCross(bt.Strategy):

def __init__(self):

self.ma20 = bt.indicators.SimpleMovingAverage(self.data.close, period=20)

self.ma50 = bt.indicators.SimpleMovingAverage(self.data.close, period=50)

def next(self):

if not self.position:

if self.ma20[0] > self.ma50[0]:

self.buy()

elif self.ma20[0] < self.ma50[0]:

self.close()

# Set up Cerebro

cerebro = bt.Cerebro()

cerebro.addstrategy(SmaCross)

cerebro.adddata(datafeed)

cerebro.broker.set_cash(10_000)

cerebro.broker.setcommission(commission=0.002)

# Run backtest

cerebro.run()

cerebro.plot()

VectorBT: Power and Performance for Quant Research

VectorBT uses vectorized operations with Numba and NumPy, enabling lightning-fast backtests of complex multi-asset portfolios. It integrates well with scientific Python tools and supports advanced analytics but has a steeper learning curve and no live trading [3].

Key Features

-

Fully vectorized, no loops required

-

Exceptionally fast for large datasets and parameter grids

-

Comprehensive indicator support (including TA-Lib integration)

-

Supports parameter sweeps and broadcasting for large-scale research

-

Extensive built-in metrics for performance analysis

-

Advanced visualization with interactive Plotly dashboards

-

Well-suited for systematic research and portfolio-level analysis

-

Strong support for cryptocurrency, stocks, FX data

Limitations

-

Not designed for live trading

-

Simplified execution assumptions (fills at prices)

-

Lacks detailed broker or order book simulation

-

Requires proficiency with NumPy/Pandas

Best Use Cases

-

Quantitative research at scale (multi-asset, multi-strategy)

-

Advanced users comfortable with Python's data science ecosystem

-

Building dashboards, analytics, and performance reports

-

Portfolio optimization and systematic model evaluation

-

Cryptocurrency and decentralized finance modeling

import vectorbt as vbt

import yfinance as yf

# Download data

data = yf.download('AAPL', start='2018-01-01', end='2024-01-01')['Close']

# Moving Averages

ma20 = vbt.MA.run(data, window=20)

ma50 = vbt.MA.run(data, window=50)

# Generate signals

entries = ma20.ma_above(ma50)

exits = ma20.ma_below(ma50)

# Portfolio simulation

pf = vbt.Portfolio.from_signals(

close=data,

entries=entries,

exits=exits,

init_cash=10_000,

fees=0.002

)

# Plot

pf.plot().show()

# Performance stats

print(pf.stats())

Comparison Table

| Feature | backtesting.py | Backtrader | vectorbt |

|---|---|---|---|

| Speed / Scalability | Slow on large data | Moderate | Extremely fast |

| Architecture | Procedural, per-bar | Event-driven | Fully vectorized |

| Multi-Asset Support | Single asset only | Multi-asset, multi-timeframe | Multi-asset, large-scale |

| Live Trading Integration | None | Possible via extensions | None |

| Order Types | Basic market, position | Full (stop, limit, OCO) | Simplified signal logic |

| Slippage / Fees | Basic parameters | Detailed modeling | Simplified assumptions |

| Performance Analysis | Basic metrics | Moderate reporting | Extensive metrics |

| Visualization | Interactive HTML | Matplotlib-based | Interactive, Plotly |

| Learning Curve | Easiest | Steep | Moderate (if familiar with Pandas) |

| Community / Maturity | Small but active | Large, mature | Rapidly growing |

Choosing the Right Tool

| If your goal is... | Recommended Library |

|---|---|

| Learning backtesting fundamentals | backtesting.py |

| Building realistic, broker-style trading systems | Backtrader |

| Running large-scale, systematic analysis | vectorbt |

Practical Workflow Recommendation

-

Prototype ideas quickly with

backtesting.py -

Validate execution realism with

Backtrader -

Scale research, optimize parameters, and run large scenarios with

vectorbt

The Real World of Python Backtesting: Beyond the Basics

Backtesting is widely recognized as a foundational pillar in developing algorithmic trading strategies. Python’s libraries make it accessible to prototype and validate ideas. Yet, the true challenge lies beyond installing and running these frameworks. Backtesting tests your rigor, discipline, and capacity to learn from failure.

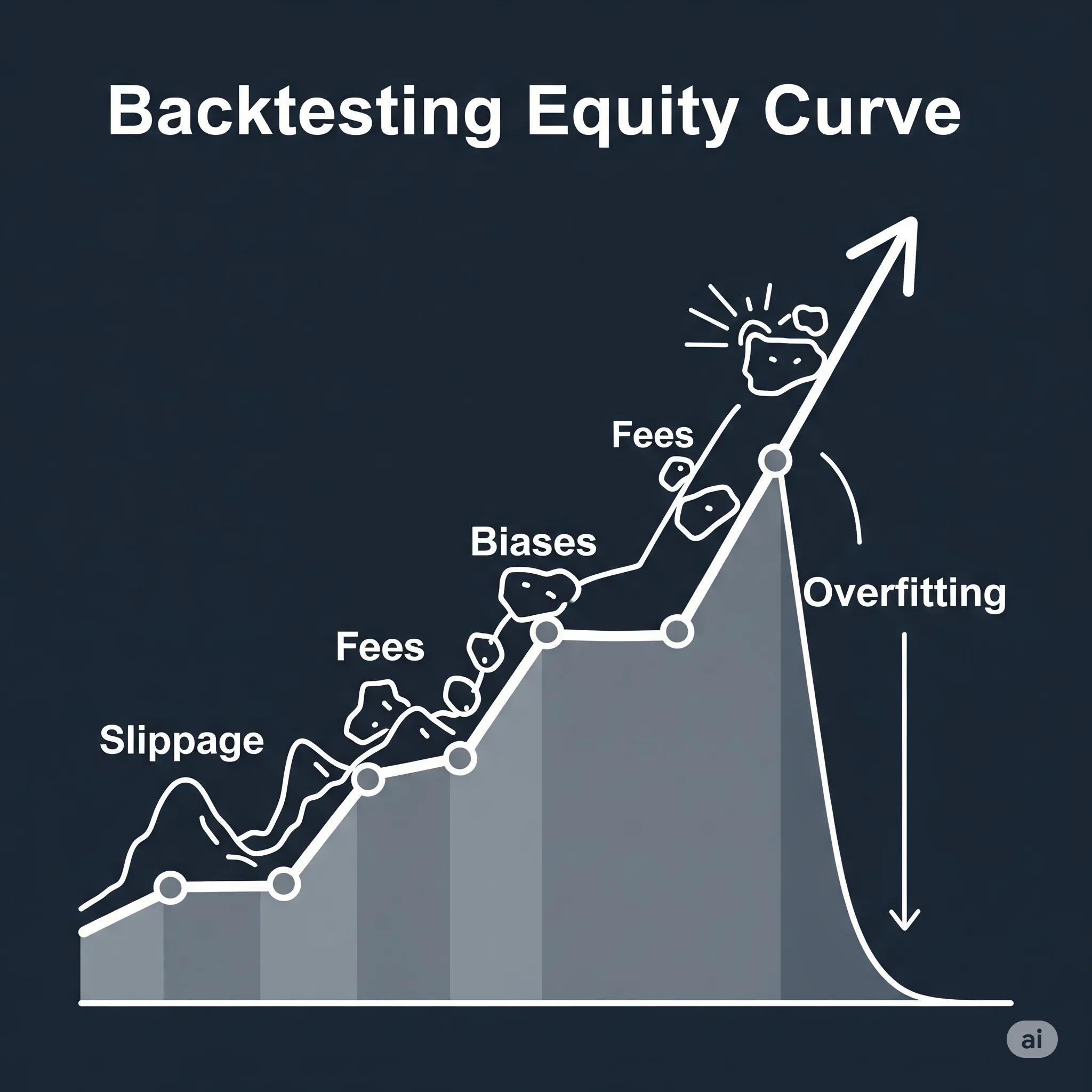

Why Realism Matters: Pitfalls That Can Derail Your Backtest

Many beginners jump straight to coding strategies but miss subtle market frictions. For example, ignoring slippage—the difference between expected and actual trade prices—or transaction commissions can transform an apparently profitable backtest into a money-losing proposition in real markets. Fortunately, most mature Python libraries allow specifying commissions and slippage models, but these features are often misconfigured or overlooked, resulting in unrealistic “paper profits.”

Data quality presents another minefield. Survivorship bias occurs when backtests only include stocks that survived until today, ignoring delisted or bankrupt companies. This inflates performance metrics and undermines credibility. Public datasets, such as those from Yahoo Finance, sometimes fail to adjust for corporate actions or include delisted assets. Niche providers and academic portals can supply cleaner data, but it requires effort to find and integrate these sources.

Common but Overlooked Pitfalls and How to Avoid Them

| Pitfall | What Happens | How to Mitigate | Example / Resource |

|---|---|---|---|

| Ignoring slippage/fees | Unrealistic “paper profits” as trades assume perfect fills | Always model realistic commissions, bid/ask spreads, and slippage | bt.broker.setcommission(commission=0.001) (Backtrader); Backtrader Docs - Commission |

| Data snooping | Overfitting to quirks in historical data; strategy looks great on paper but fails live | Use strict out-of-sample testing, walk-forward validation, and don’t tweak rules post hoc | cross_validate in vectorbt |

| Survivorship bias | Overstated performance by excluding delisted or bankrupt companies | Use survivor-bias-free datasets (Quandl, Kibot, Norgate Data) | Survivorship Bias Explained |

| Ambiguous order handling | Unrealistic fills, trades executed at next-bar open without accounting for liquidity | Simulate realistic slippage, latency, and bar-by-bar fills; review order logs | Backtesting.py’s exclusive_orders=True; Backtrader’s replay mode |

| Strategy “creep” | Constant tweaking of rules until results look good; leads to fragile strategies | Keep detailed changelogs; commit to fixed testing windows; avoid changing parameters mid-backtest | Keep version-controlled notebooks (e.g., with Jupyter + Git) |

| Lookahead bias | Using future data unknowingly (e.g., indicators peeking ahead) | Ensure no future bars influence decisions; shift signals appropriately | shift(1) for signal columns in Pandas, or forward-looking checks in libraries |

| Ignoring market regime changes | Strategy fails when conditions change (bull vs. bear markets) | Test across multiple market regimes; use regime filters in strategy logic | Detect regime via volatility, moving averages, etc. Example: Hurst Exponent |

| Over-reliance on simple metrics | Focus only on cumulative return, ignoring drawdowns or volatility | Analyze Sharpe, Sortino, Max Drawdown, Calmar Ratio, etc. | pyfolio, vectorbt for performance tearsheets |

| Unrealistic execution assumptions | Trading infinite volume with zero slippage on illiquid stocks | Integrate volume-based position sizing, slippage models | commission and slippage models in Backtrader or Backtesting.py |

![]()

One surprising insight from forums such as /r/algotrading is that many backtest failures come from overlooked data issues or unrealistic assumptions rather than flawed strategy ideas themselves [4].

Strategy Graveyards: Embracing Failure to Improve

One practice adopted by experienced quants is maintaining a strategy graveyard, a catalog of backtests that failed or revealed hidden biases. Instead of discarding failed experiments, logging their details helps avoid repeating mistakes and identifies patterns in overfitting or unrealistic assumptions.

For example, a trader might discover that a promising strategy relied on look-ahead bias by unintentionally using future data in indicator calculations. Recording this failure fosters humility and accelerates growth.

Seasoned traders often treat failed backtests not as wastes but as vital lessons that reveal hidden biases and help refine their approach [5].

Getting Unstuck: Community Secrets and Troubleshooting Routines

When technical or conceptual challenges arise, many users find unexpected support in smaller, specialized communities. Beyond popular forums like /r/algotrading or /r/quant, Discord servers dedicated to specific Python libraries or algorithmic trading projects provide real-time help, code reviews, and advanced discussions.

Experienced practitioners often follow disciplined debugging routines, such as:

-

Simplifying code to minimal examples that reproduce the bug

-

Narrowing down whether issues stem from data, logic, or assumptions

-

Swapping snippets with peers for fresh eyes

These habits save hours and reduce frustration but are rarely emphasized in introductory materials [6].

Beyond Stocks: Customizing for Crypto, FX, and Futures

Most libraries were designed with equities in mind. Crypto, FX, and futures markets often have 24/7 trading, unique tickers, or different settlement rules.

Applying backtesting tools in these markets requires careful customization—adjusting time alignment, handling non-standard trading hours, and modifying order logic. While possible, this takes work and testing, so do not assume plug-and-play [7].

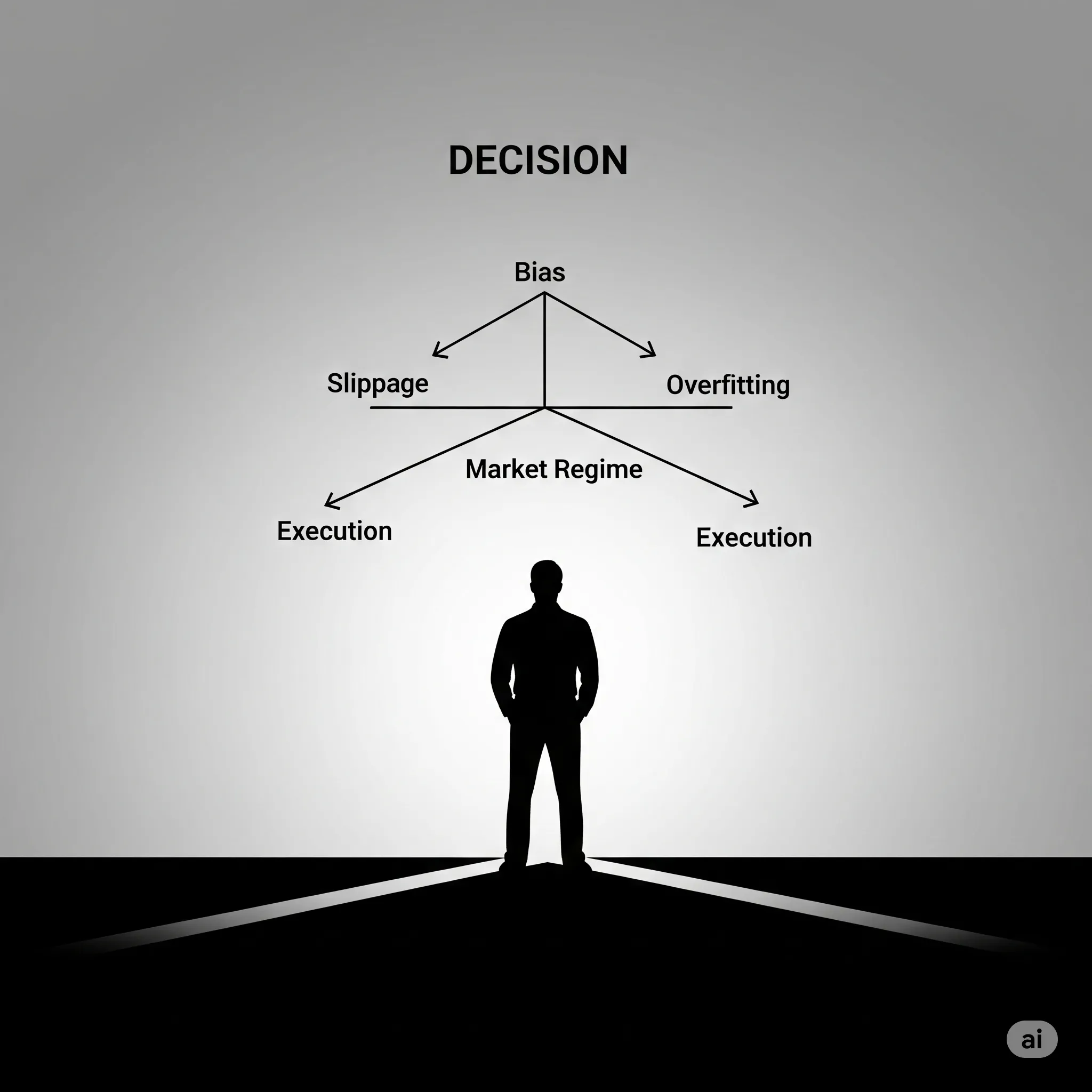

Psychological Truths of Backtesting: Discipline Over Data

The greatest edge is not the fanciest code but your mindset.

Successful backtesters treat every beautiful equity curve with skepticism and ask:

-

What hidden assumptions created this result?

-

Does it hold across multiple data sets and market regimes?

-

How does it perform under higher commissions or random delays?

They keep detailed logs not just of code changes but of why changes were made. Sharing results openly for critique is common to catch blind spots [8].

Conclusion: The Real Test Is the Process

Backtesting is a journey—technical, psychological, and methodological. Tools like Pandas, backtesting.py, Backtrader, and VectorBT offer paths forward, but none are magic. The best strategies emerge from curiosity, rigorous validation, community feedback, and humility in the face of market complexity.

If you are starting out, build your foundation with Pandas, experiment with simple libraries, and then advance carefully, always questioning your results and learning from setbacks.

This mindset shift—from code as king to process as kingmaker—is the greatest gift backtesting can give you.

References

-

Backtesting.py Documentation, https://kernc.github.io/backtesting.py/

-

Backtrader Documentation, https://www.backtrader.com/docu/

-

VectorBT Documentation, https://vectorbt.dev/

-

Reddit /r/algotrading and /r/quant community discussions, 2023–2025

-

Chan, E. (2013). Algorithmic Trading: Winning Strategies and Their Rationale. Wiley.

-

Online community insights from Discord and niche forums (personal observations)

-

Adaptation challenges in crypto and FX markets discussed on /r/FinancialEngineering

-

Bailey, D., & López de Prado, M. (2014). "The Probability of Backtest Overfitting," Journal of Computational Finance