In late 2022, I watched a friend lose nearly half his trading account in a single month. He wasn’t reckless or uninformed. He had studied markets, obsessed over charts, and listened to countless investing podcasts. But there was one gap in his education that cost him dearly: risk management.

This is a common story. Whether you’re trading stocks, investing in property, or managing a retirement account, the harshest lessons of finance often arrive late—and expensively.

What follows is a practical guide to risk management, rooted in real examples, behavioral truths, and a simple question: How do you protect your capital in a world that rarely goes according to plan?

Why Risk Management Deserves More Attention than Predictions

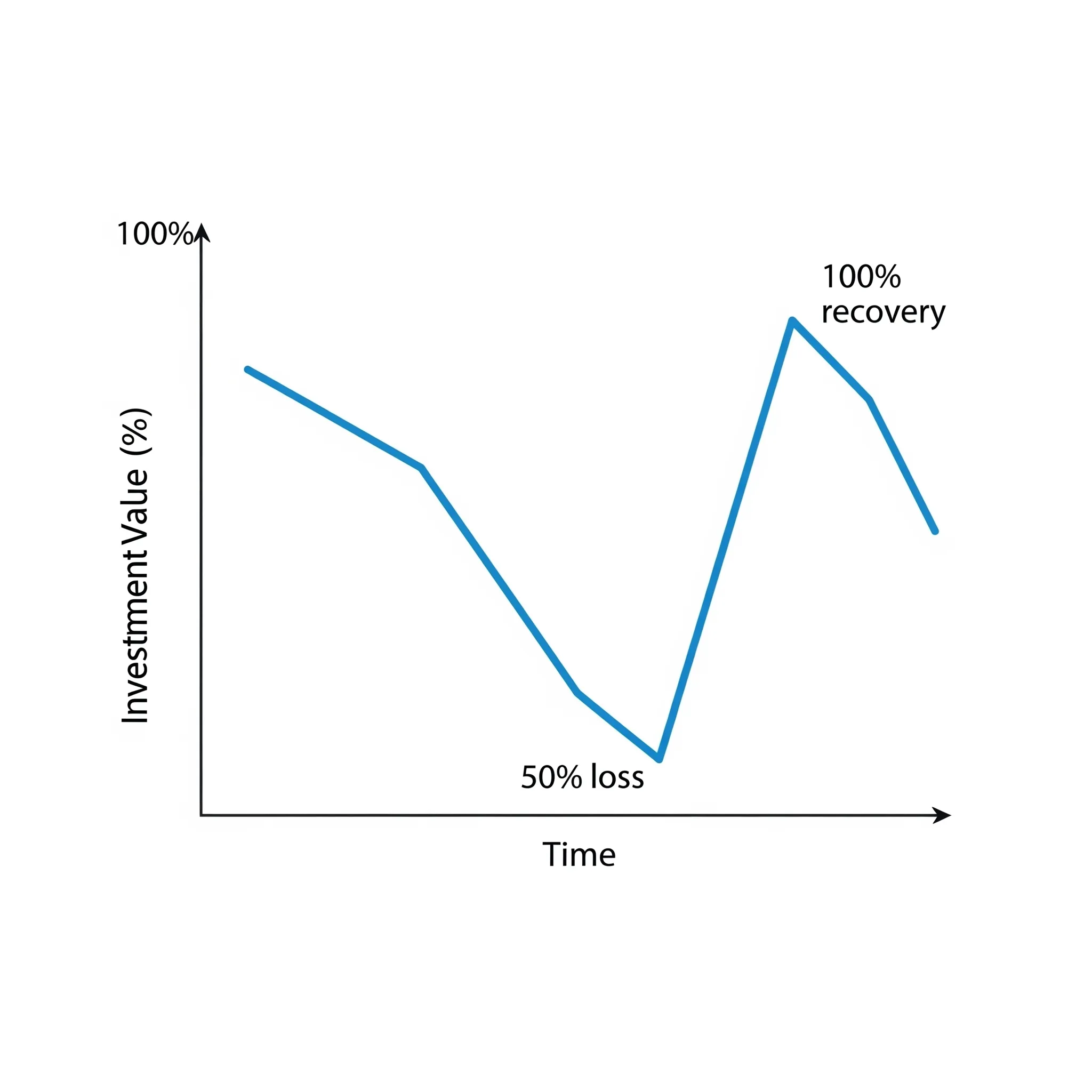

It’s easy to obsess over forecasts—interest rates, GDP growth, earnings reports. But ask any seasoned investor: survival is what matters most. A 50 percent loss requires a 100 percent gain to recover. The deeper the loss, the harder the climb back [1].

The world’s most successful investors are not consistently right because they predict markets better; they succeed because they survive mistakes better [2]. Risk management isn’t about eliminating risk. It’s about ensuring no single mistake—yours or the market’s—ruins you.

The Three Dimensions of Effective Risk Management

1. Financial Structures That Protect You

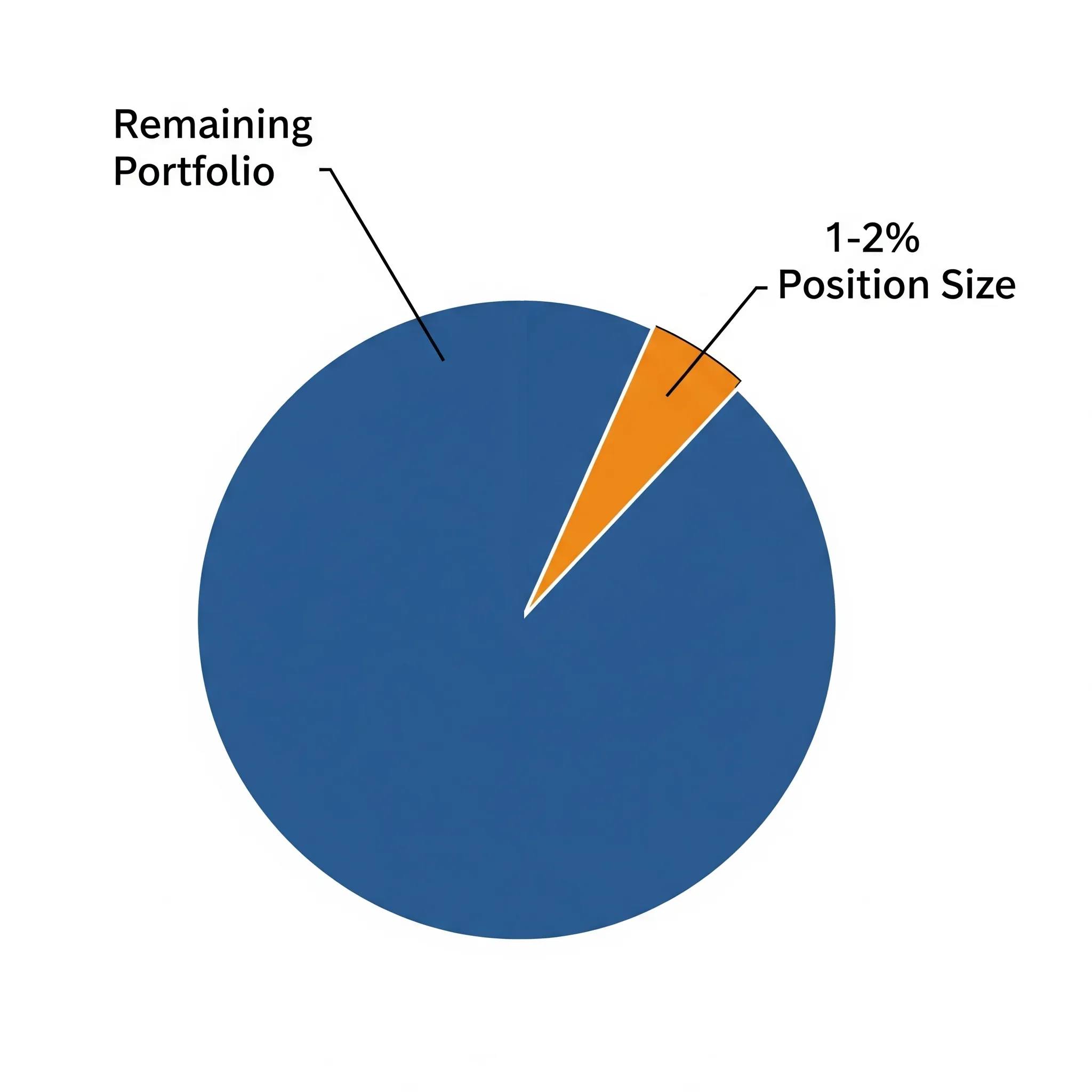

Position Sizing The simplest way to control risk is limiting how much of your capital any single decision can lose. Professionals often risk no more than 1-2 percent of total capital on one trade or investment [3]. It’s not about how much you invest; it’s how much you can afford to lose without consequence.

But how do you calculate this for your personal portfolio? Tools like the Kelly Criterion, originally developed for betting, can help find an optimal position size based on your win rate and payoff ratios, though many investors keep it simpler by sticking to conservative percentages.

Diversification Done Properly True diversification isn’t about the number of stocks you own; it’s about how differently your assets behave in crises. Bonds, equities, commodities, and cash each respond differently under pressure. For example, in 2008, U.S. Treasury bonds rose even as stocks collapsed [4].

But beware of “false diversification.” Many portfolios contain assets that correlate strongly in downturns, leaving investors exposed to broad market shocks.

Liquidity Awareness Illiquid assets—real estate, small-cap stocks, private equity—can trap capital when flexibility matters most. The 2020 pandemic showed how liquidity can vanish overnight [5]. Always ask: If I needed this money fast, could I get it?

Institutions like the Yale Endowment balance liquidity by dividing assets into tiers: immediate liquidity for spending, semi-liquid for medium-term growth, and illiquid for long-term bets. Individuals can mimic this by matching assets to time horizons.

2. Psychological Resilience: Knowing Yourself Before the Market Tests You

Risk Tolerance Beyond Questionnaires Forget the typical “moderate” or “aggressive” investor forms. A better test: Imagine your portfolio drops 30 percent. What would you do? Behavioral experiments, paper trading, and journaling emotional reactions provide more clarity than any form.

The Psychology of Loss Studies show people feel the pain of losses roughly twice as intensely as gains [6]. Writing rules ahead of time—when to sell, when to rebalance—prevents panic decisions later. Professionals don’t trust emotion; they trust process.

Building Resilience Without a Crash You don’t need to wait for a market crisis to build psychological strength. Run “fire drills” with paper trades or hypothetical scenarios. Track your reactions to financial news and reflect on past decisions under pressure.

This mental rehearsal prepares you to act calmly when real volatility strikes.

Planning for the Worst Institutions use stress tests and scenario analysis. You can too. Ask yourself: Could I survive three consecutive bad years? What if inflation stays high for a decade? What if I lose my job tomorrow?

Preparing for extremes ensures they don’t destroy you.

3. Hidden Risks in Everyday Financial Life

Risk doesn’t only live in markets. Consider:

-

Over-concentration in employer stock—feels safe until it isn’t.

-

Taking on mortgage debt disproportionate to income stability.

-

Underestimating the long-term risk of healthcare costs.

-

Assuming steady income in a rapidly changing job market.

Financial resilience comes from seeing the full picture, not just the portfolio.

How Risk Changes Over Time — And So Should Your Plan

The risks you face at 25 aren’t the same as those at 55. Early in your career, missing opportunities might be your biggest risk. Later, it’s protecting what you’ve earned. Risk management is a living strategy that must evolve with your life stage.

-

Early Career: Focus on growth but keep downside manageable.

-

Mid-Life: Emphasize stability, income protection, and diversification.

-

Retirement: Prioritize preservation, healthcare, and inflation hedging.

Adjusting your risk plan with life’s seasons is key to long-term survival.

The Danger of Playing It Too Safe

Being overly cautious carries its own risks. Inflation erodes cash value. Sitting out of markets can cost decades of growth. After 2008, many avoided stocks and missed one of the longest bull markets in history [8].

Risk management is not hiding from risk; it is being deliberate in which risks you embrace and which you refuse.

Practical Tools for Building Your Own Risk Plan

The Three-Bucket System

-

Short-term needs (1-3 years): Cash, bonds, liquid assets.

-

Medium-term goals (3-10 years): Balanced, diversified investments.

-

Long-term growth (10+ years): Higher-risk, growth-focused strategies.

This structure aligns your time horizon with your risk tolerance—not guesswork.

Behavioral Journaling Exercise Track your emotional responses to market news or paper trades. Over time, patterns emerge. Are you steady or prone to panic? Self-awareness beats theory.

Scenario Planning Questions

-

What if my investments drop 30 percent tomorrow?

-

How would I adjust if my industry faces layoffs?

-

Do I have emergency cash to cover six months?

-

Is my portfolio too dependent on a single asset or assumption?

These questions clarify your true resilience.

Using Technology Explore tools like Portfolio Visualizer’s Monte Carlo simulations to stress-test your portfolio. Simple Kelly Criterion calculators can help you decide how much to risk per trade or investment.

Closing Thought: Survival First, Then Success

I still think about my friend’s blown-up account. He’s recovered—slowly, cautiously. He learned, as I hope you do, that markets punish ignorance of risk more harshly than ignorance of opportunity.

Your capital is finite. The opportunities to lose it are infinite. Manage accordingly.

References

- "The Arithmetic of Investment Losses," CFA Institute, 2020.

- Hagstrom, R.G., The Warren Buffett Way, Wiley, 2013.

- Van Tharp, Trade Your Way to Financial Freedom, McGraw-Hill, 2007.

- "The Role of Bonds in Diversified Portfolios," Vanguard Research, 2021.

- "Liquidity in Crisis: Lessons from the COVID Crash," Bank for International Settlements, 2020.

- Barber, B.M., & Odean, T., "Trading is Hazardous to Your Wealth," Journal of Finance, 2000.

- Lowenstein, R., When Genius Failed: The Rise and Fall of Long-Term Capital Management, Random House, 2000.

- "Mind the Gap 2021," Morningstar Research, 2021.