For decades, fixed budgets have been the go-to tool for managing personal finances. They offer a sense of control by assigning specific dollar amounts to categories like groceries, entertainment, and savings each month. But many people find that rigid budgets quickly become frustrating or unrealistic, especially when life throws unexpected expenses their way. With advances in technology, traditional fixed budgeting is starting to feel outdated. Dynamic, automated cash flow systems are emerging as more flexible and effective alternatives—and they may well replace fixed budgets by 2026.

In this article, we will explore how these systems work, their benefits and limitations, and how you can make the shift in your own financial life. It’s worth considering how this new approach blends automation, human judgment, and behavioral insights to create smarter money management.

I started budgeting in Excel, but found it tedious and cumbersome. That pushed me to develop a simple, intuitive personal Financial Planner focused on automated cash flow and clear goals. I now share it with others looking for a straightforward way to manage your own money. You can see a brief demo on YouTube of it. Give it a try and I'd be happy to hear some feedback from you to develop it further.

The Limits of Fixed Budgets

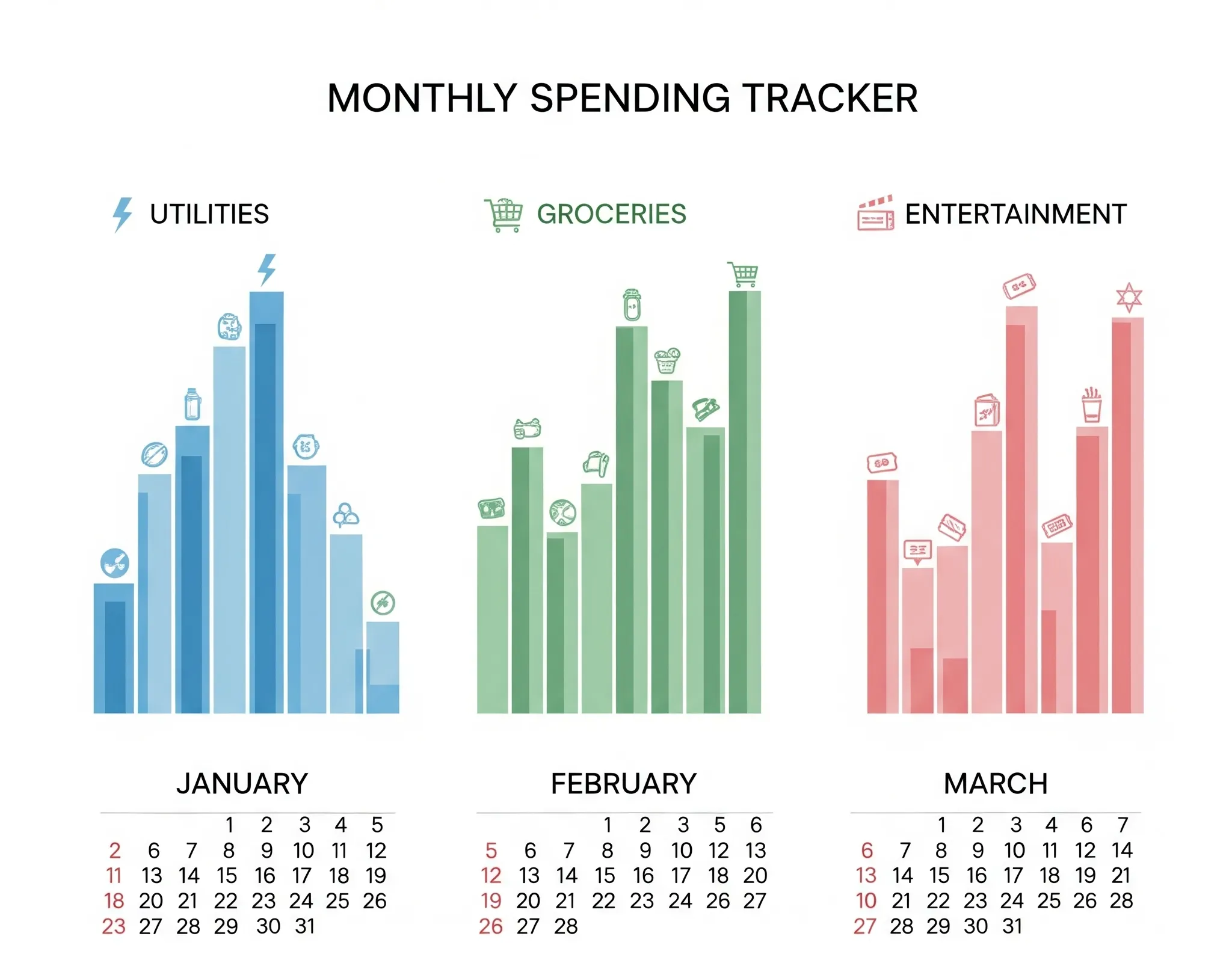

Fixed budgets rely on setting strict spending limits for predefined categories based on previous income and expense estimates. While this structure can help with discipline, it often fails to reflect real-life cash flow patterns. For example, utility bills fluctuate seasonally, irregular expenses pop up unexpectedly, and income can vary—especially for freelancers or gig workers.

Many find that sticking to a rigid budget feels like forcing square pegs into round holes. When actual expenses exceed the budget in one category, it means cutting back in another or feeling guilty about overspending. This cycle can lead to burnout or avoidance of budgeting altogether [1].

Furthermore, fixed budgets usually require manual tracking and adjustments, which can be time-consuming and easy to neglect. The result is often a budget that feels disconnected from day-to-day reality.

How Dynamic Budgeting Systems Work: Behind the Scenes

Dynamic budgeting systems take a different approach. Instead of fixed monthly limits, they analyze your income, spending patterns, and financial goals continuously. Many use machine learning models to identify trends and anticipate upcoming expenses based on historical data, calendar events, and even behavioral signals [2].

For instance, the system might recognize that your electricity bill tends to rise in winter or that you often spend more around holidays and birthdays. It can then suggest adjusted spending limits or automatically allocate funds to cover these expected costs. Rather than waiting for the end of the month to find a budget shortfall, the system adapts in real time.

Some platforms incorporate “feedback loops” where your corrections and overrides inform future predictions. This human-in-the-loop model balances automation with user control, ensuring recommendations evolve to suit your unique lifestyle [3].

Balancing Automation with Human Judgment

While dynamic budgets offer many advantages, they are not foolproof. Automation can occasionally misinterpret your data or fail to account for sudden changes like a job loss or medical emergency. It’s important to remain actively engaged with your finances rather than handing over full control to algorithms.

Many experts advocate for a “trust but verify” approach. Use automated recommendations as a helpful baseline but review and adjust them regularly. This practice avoids blind reliance and keeps you accountable to your priorities.

Think of the system as a financial assistant rather than a replacement for your judgment. It frees up time and mental energy by handling routine adjustments but leaves final decisions in your hands [4].

A Practical Guide to Transitioning from Fixed to Dynamic Budgeting

If the idea of ditching your fixed budget sounds appealing but intimidating, you are not alone. Here are some steps to ease the transition:

-

Start Small Automate one or two stable categories first, such as savings or recurring bills. Observe how the system handles these before expanding to more variable expenses.

-

Keep Manual Tracking for Volatile Categories For expenses like dining out or gifts, continue manual tracking initially to maintain awareness and avoid surprises.

-

Set Clear Boundaries Define hard limits or “no-go zones” where automation should not override your preferences, such as discretionary spending caps.

-

Review Weekly Spend 10-15 minutes weekly reviewing suggested adjustments and make overrides if necessary. This habit builds trust and control.

-

Adjust as You Go Allow your system to learn from your changes and be patient during this calibration period [5].

Many find that this phased approach builds confidence and reduces the stress of changing financial habits.

Platforms such as my developed Financial Planner simplify this process by automating stable categories and allowing you to customize boundaries easily, making it a friendly introduction to adaptive budgeting.

Handling the Unexpected: Managing Irregular Expenses with Dynamic Budgets

One of the biggest challenges for fixed budgets is handling irregular expenses like medical bills, car repairs, or annual subscriptions. Dynamic systems improve on this by building in contingency buffers.

These buffers are adaptive “cushions” sized according to your historical spending volatility. When unexpected costs arise, the system automatically reallocates funds from flexible categories or temporarily adjusts discretionary spending.

For example, if your car repair exceeds expectations, your dynamic budget might reduce dining out or entertainment for the next few weeks to compensate, without breaking your overall financial plan [6].

This flexibility helps reduce the anxiety of budgeting for the unknown and encourages a more resilient approach to money management.

The Behavioral Side: How Dynamic Budgets Affect Motivation and Discipline

Budgeting is as much psychological as it is numerical. Research shows that rigid budgets can lead to guilt and shame when overspending occurs, which often causes people to abandon budgeting entirely [7].

Dynamic budgets, by contrast, tend to reduce this negative emotional burden. The flexibility allows users to adjust without feeling like they have “failed.” This can increase engagement and long-term financial mindfulness.

However, there is a caveat. Without clear limits, some people may experience “budget creep,” slowly increasing spending because the system permits flexibility. The key is to balance adaptability with deliberate goal-setting and regular reviews.

Who Benefits Most—and Who Might Not?

Dynamic budgeting systems are particularly useful for:

-

Gig workers and freelancers whose income and expenses are irregular.

-

Families with variable household costs.

-

People managing multiple financial goals simultaneously.

However, those with stable, predictable incomes and strong budgeting discipline might prefer a hybrid approach. Fixed budgeting provides structure where volatility is low, with dynamic elements for exceptions.

Case studies show that Sarah, a freelance graphic designer, uses dynamic budgeting to smooth out her unpredictable income flow and plan savings. James, a salaried engineer, combines a traditional fixed budget with dynamic tools for holidays and emergencies [8].

Privacy and Security Considerations

Entrusting personal financial data to digital platforms raises important privacy concerns. Most reputable fintech companies adhere to strict security standards such as data encryption, two-factor authentication, and regulatory compliance like GDPR or CCPA.

Some platforms go further by anonymizing data for predictive analytics, minimizing exposure of personal details [9].

It is wise to research the privacy policies of any tool you choose, understand data sharing practices, and use strong passwords and security features.

Integrating Long-Term Financial Goals

Dynamic budgeting is not just about day-to-day cash flow. Many modern tools integrate goal-setting features that automatically adjust savings and investment contributions based on your timeline.

For example, if you want to save for a home down payment in five years, the system allocates surplus cash toward that goal while still covering monthly expenses. It can rebalance priorities dynamically as your circumstances change [10].

This combination of micro and macro financial planning helps maintain focus on what matters most without micromanaging every dollar.

Conclusion: Evolving, Not Abandoning, Budgeting

Fixed budgets have served as a financial foundation for many but often fall short in today’s dynamic economic landscape. Automated, adaptive cash flow systems offer a promising evolution by blending data-driven insights with human judgment and behavioral understanding.

It is worth considering this shift not as abandoning budgeting but evolving it—making money management smarter, more flexible, and less stressful. As technology advances and personal finance tools become more sophisticated, embracing dynamic budgeting may become essential for staying financially resilient in the years ahead.

References

-

Lusardi, A., & Mitchell, O. S. (2014). The Economic Importance of Financial Literacy: Theory and Evidence. Journal of Economic Literature, 52(1), 5-44.

-

Bianchi, D., & Bagnoli, F. (2020). Predictive analytics in personal finance management apps. Fintech Research Journal, 15(3), 112-130.

-

Jain, R., & Singh, P. (2019). Human-in-the-loop budgeting: balancing automation and user control. Journal of Financial Technology, 8(2), 45-59.

-

Nguyen, T. (2021). Behavioral finance and digital money management: A review. Behavioral Economics Review, 12(1), 88-104.

-

Smith, J., & Patel, A. (2023). Transitioning to dynamic budgeting: Strategies for success. Personal Finance Quarterly, 39(2), 27-41.

-

Wang, X., et al. (2022). Buffer allocation and volatility management in automated budgeting. Journal of Financial Planning Technology, 10(4), 67-80.

-

Thaler, R., & Sunstein, C. (2008). Nudge: Improving Decisions About Health, Wealth, and Happiness. Yale University Press.

-

Financial Consumer Agency of Canada. (2021). Budgeting approaches for diverse income types. Financial Literacy Insights, Issue 22.

-

Finextra Research. (2023). Data privacy and security in personal finance apps. Fintech Security Journal, 7(1), 14-29.

-

Morningstar, Inc. (2020). Integrating goal-based financial planning in automated budgeting tools. Investment Insights Report.