The Quiet Power of a Plan

When I first heard the term "financial planning," I assumed it was something reserved for high-net-worth individuals with accountants on speed dial. It sounded distant, even clinical. But over time, I have come to see financial planning not as some elite strategy, but as a practical framework that can bring stability, clarity, and confidence to nearly anyone's life.

This article is for everyday people: young professionals figuring things out, families managing competing priorities, and anyone who has ever wondered, "Am I doing enough with my money?" It offers a foundational understanding of personal finance that is clear, honest, and applicable. Think of it as a thoughtful guide, informed but grounded, with just enough structure to help you feel equipped, not overwhelmed.

What Is Financial Planning?

Financial planning is the ongoing process of managing your money so you can achieve your goals. It includes budgeting, saving, investing, handling debt, preparing for taxes, and protecting what you value. It is not just about growing wealth. It is about making intentional choices with what you have now.

In fact, studies show that people who create a written financial plan are more confident and more likely to reach their goals, regardless of income level [1]. Planning does not require perfection, just progress.

1. Setting Financial Goals

Start by asking: What matters most to you? Financial goals usually fall into three categories:

-

Short-term (0 to 2 years): paying off credit card debt, building an emergency fund, saving for a trip

-

Medium-term (3 to 7 years): buying a car, switching careers, starting a business

-

Long-term (more than 7 years): retirement, owning a home, funding a child's education

Use the SMART framework: goals should be Specific, Measurable, Achievable, Relevant, and Time-bound [2]. Many find that simply articulating a goal, even loosely, brings more clarity to daily decisions.

2. Budgeting: The Backbone of Your Plan

A budget is not about restriction. It is about alignment. It helps ensure your spending reflects your priorities. Some proven methods include:

-

50/30/20 Rule: 50 percent for needs, 30 percent for wants, 20 percent for savings or debt

-

Zero-Based Budgeting: assign every dollar a role

-

Envelope System: allocate cash to specific categories, especially useful for discretionary spending

Popular tools include YNAB (You Need a Budget), Mint, and basic spreadsheets. You can also try this simple financial planner I created, designed for clarity and ease of use. Choose the one you will actually use.

3. Managing Income and Expenses

It is surprisingly easy to lose track of where your money goes. Regularly reviewing your income and spending can highlight areas to adjust.

-

Fixed expenses: rent, insurance, loan payments

-

Variable expenses: food, transportation, entertainment

Start by reviewing last month’s bank or credit card statements. Many are surprised by how much goes toward small, recurring charges.

4. Building an Emergency Fund

An emergency fund is your financial buffer. It prevents short-term setbacks from becoming long-term debt. Experts recommend saving three to six months of essential expenses [3].

Keep this fund in a separate high-yield savings account to avoid dipping into it casually.

5. Debt Management

Not all debt is created equal. Understanding its role helps you navigate it more confidently.

-

Constructive debt: mortgages or student loans that contribute to long-term value

-

Problematic debt: high-interest credit card balances or payday loans

Common strategies include:

-

Snowball method: pay smallest debts first to build momentum

-

Avalanche method: prioritize debts with the highest interest rates to save money

-

Consolidation: combine debts into a single lower-interest loan

Also, keep an eye on your credit score. It affects everything from loan approvals to apartment rentals [4].

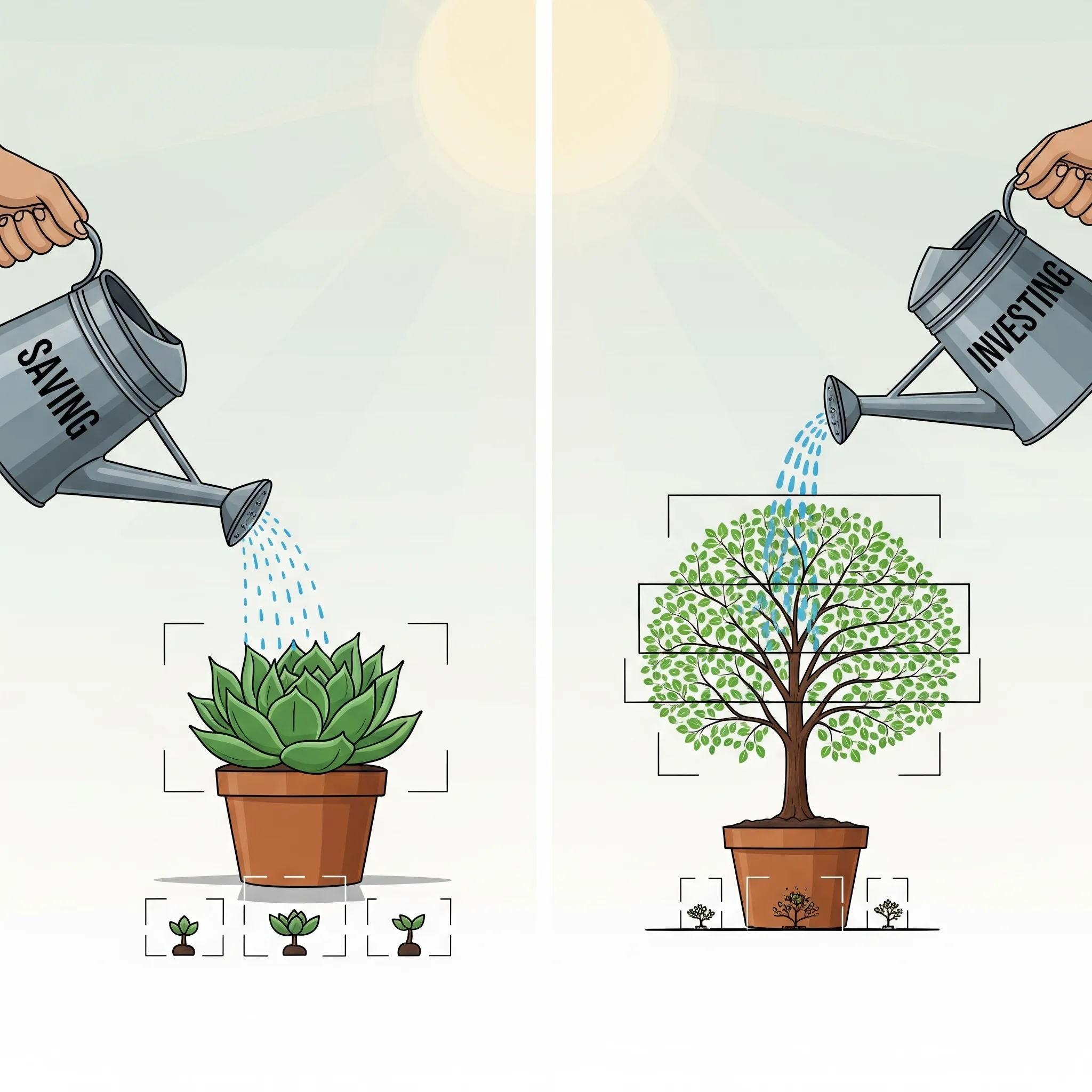

6. Saving vs. Investing

Saving keeps money safe. Investing helps it grow.

Savings are best for short-term goals and emergencies. Investments, while riskier, are essential for long-term goals like retirement. The earlier you start, the more compound interest works in your favor.

For example, investing just one hundred dollars per month from age twenty-five can grow to over two hundred thousand dollars by retirement, assuming a seven percent return [5].

Start with tax-advantaged accounts like:

-

401(k): especially if your employer matches contributions

-

IRA or Roth IRA: ideal for individual retirement savings

Avoid overcomplication. Index funds and robo-advisors are solid options for beginners.

7. Insurance and Risk Management

Insurance is about safeguarding what matters. It may not feel urgent until it is.

Key types to consider:

-

Health insurance: a must-have in most contexts

-

Life insurance: especially if others rely on your income

-

Disability insurance: often overlooked but crucial

-

Property insurance: auto, renters, or homeowners

Review policies annually, especially after life changes like a move, job change, or having a child.

8. Tax Planning

Taxes are not just a once-a-year concern. Thoughtful planning can reduce what you owe and help you keep more of what you earn.

-

Contribute to tax-advantaged accounts such as 401(k), HSA, or IRA

-

Understand your eligible deductions and credits

-

Stay organized throughout the year, not just in April

If your situation is complex, hiring a tax professional might save more than it costs.

9. Estate Planning

Estate planning is about control and clarity. Even a basic plan helps avoid confusion during difficult times.

-

Draft a simple will

-

Assign power of attorney and healthcare proxy

-

Name beneficiaries on retirement and insurance accounts

It may feel premature, but doing it now can be an act of kindness to those you love.

Common Questions Readers Might Have

Where do I actually start if I am overwhelmed? Begin with tracking your expenses and setting a small emergency fund goal. These two steps create momentum.

Is financial planning really that different across income levels? The tools and principles are largely the same. What changes is the scale and complexity. The earlier you adopt the habits, the better they serve you.

How do I stay motivated? Tie your goals to something personal. Saving for a vague future can feel abstract. Saving to take time off work or to support your family is tangible.

How do emotions affect financial planning? A great deal. Scarcity, fear, or shame can cloud judgment. That is why tracking and planning are helpful. They create space between you and impulsive decisions.

A Few Common Mistakes to Avoid

-

Delaying saving because the amount seems too small

-

Assuming budgeting means restriction

-

Underestimating recurring small expenses

-

Neglecting insurance or estate documents

-

Ignoring your financial habits or emotional triggers

The Bottom Line

Financial planning is not about getting rich. It is about feeling capable, intentional, and calm when making decisions with your money.

Start small. Build gradually. Focus on progress, not perfection. Over time, these habits compound just like your investments.

References

-

Schwab Modern Wealth Survey 2023: https://www.aboutschwab.com/modern-wealth-survey

-

Doran, G. T. (1981). "There's a S.M.A.R.T. way to write management's goals and objectives." Management Review.

-

Consumer Financial Protection Bureau. "Emergency savings." https://www.consumerfinance.gov/

-

Federal Trade Commission. "Coping with Debt." https://consumer.ftc.gov/

-

Securities and Exchange Commission. "Compound Interest Calculator." https://www.investor.gov/

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Please consult a licensed financial advisor for personalized guidance.